Are we witnessing artificial Bitcoin price suppression? If so, paper Bitcoin is probably to blame. Let’s examine the concept, the previous known cases, and the fact that the ETFs are buying record quantities of BTC without moving the price. Even though, let’s face it, it’s up 50% since the US SEC approved the spot ETFs, and BlackRock, Fidelity, and the others started buying.

Is that enough, considering the inflows? That’s the question.

Another factor--and this is extremely suspicious--is that most of the ETFs use Coinbase as a custodian. Can we trust that company? Something wicked might be afoot; Wall Street might be trying to pull one on us. On the other hand, long-term holders might be leveraging the newfound demand to sell and make a profit. That would be normal post-halving behavior and indicate the cycle is gathering steam as it usually does.

Let’s explore the case with a fine-tooth comb, starting with…

Paper Money, A Definition

In 1729, during a shortage of gold and silver coins in the US, Benjamin Franklin published the pamphlet “

**“I cannot think it the Interest of England to oppose us in making as great a Sum of Paper Money here, as we, who are the best Judges of our own Necessities, find convenient.” \ And a few paragraphs later:

“It remains now that we enquire, Whether a large Addition to our Paper Currency will not make it sink in Value very much; And here it will be requisite that we first form just Notions of the Nature and Value of Money in general.”

The paper bitcoin analogy reflects banknotes and Central Banks getting ahold of all of the citizens’ gold by hook or by crook. The idea behind paper money was that the totality of those IOUs was supposed to represent all the country’s gold reserves. However, how could the citizens tell if their government printed more banknotes than the gold they held? They couldn’t, so the money supply grew and grew.

Then,

Paper Bitcoin, A Definition

As you should know, there will only be 21 million Bitcoin in total. There’s nothing anyone can do about that. However, exchanges and various institutions could potentially issue Bitcoin IOUs and fool the population into thinking they’re buying the real asset. The FTX case proves that centralized exchanges are able to sell paper Bitcoin without anyone noticing. More on that later.

Make no mistake, as opposed to gold, the Bitcoin blockchain is completely auditable 24/7. The 21 million Bitcoin are accounted for. However, each exchange has its internal accounting system. The BTC they sell settles through their database, which is completely off-chain. Using that ingenious system, they could be perpetuating all kinds of paper Bitcoin shenanigans. **

**

Coinbase is not legally required and has never shown proof of reserves. However, we, the bitcoiners, are on the case. If they’re issuing paper bitcoin, we will catch them sooner or later. You’ve been warned, Brian Armstrong.

The History Of Gold

To understand paper Bitcoin, we have to discuss gold’s price suppression. When banks introduced paper currency, they solved several problems. Suddenly, people could carry their money with them and transact with ease.

However, the situation allowed banks to lend their customers’ funds without their consent. Of course, as it happens, banks started to abuse that power. And since they had all of the citizens’ gold, they could control its price and eradicate it from commerce.

Private banks were part of the problem, but the main event was the US Federal Reserve, and every country’s central bank printed more bills than the gold they supposedly backed it with, which was worth more. Using that system, governments everywhere could tax the population without them knowing.

Through the power of inflation, they could fund every project they could conceive. And the incentive to be efficient and responsible disappeared. The governments could just print banknotes and inflate the money supply, devaluating the bills already in circulation in the process. And for a long time, the market was none the wiser.

People had no idea what hit them. As opposed to Bitcoin, it’s impossible to audit gold’s total supply. To this day, it’s infeasible to prove without a shadow of a doubt that governments were actively suppressing gold’s price.

However,

A Few Words About Fractional Reserve Banking

In the fiat world Nixon left us with, fractional reserve banking made sense. Governments around the world authorized banks to hold only a fraction of the money their customers deposited with them. They could legally lend the rest and charge interest for it, effectively creating even more money.

Moreover, it’s considered normal that these institutions control their customer’s withdrawals to protect themselves from a bank run. The banks simply don’t have the people’s money. That’s modern banking for you.

How do we know Bitcoin exchanges are not incurring the same practices?

The FTX Case, a Paper Bitcoin Stravaganza

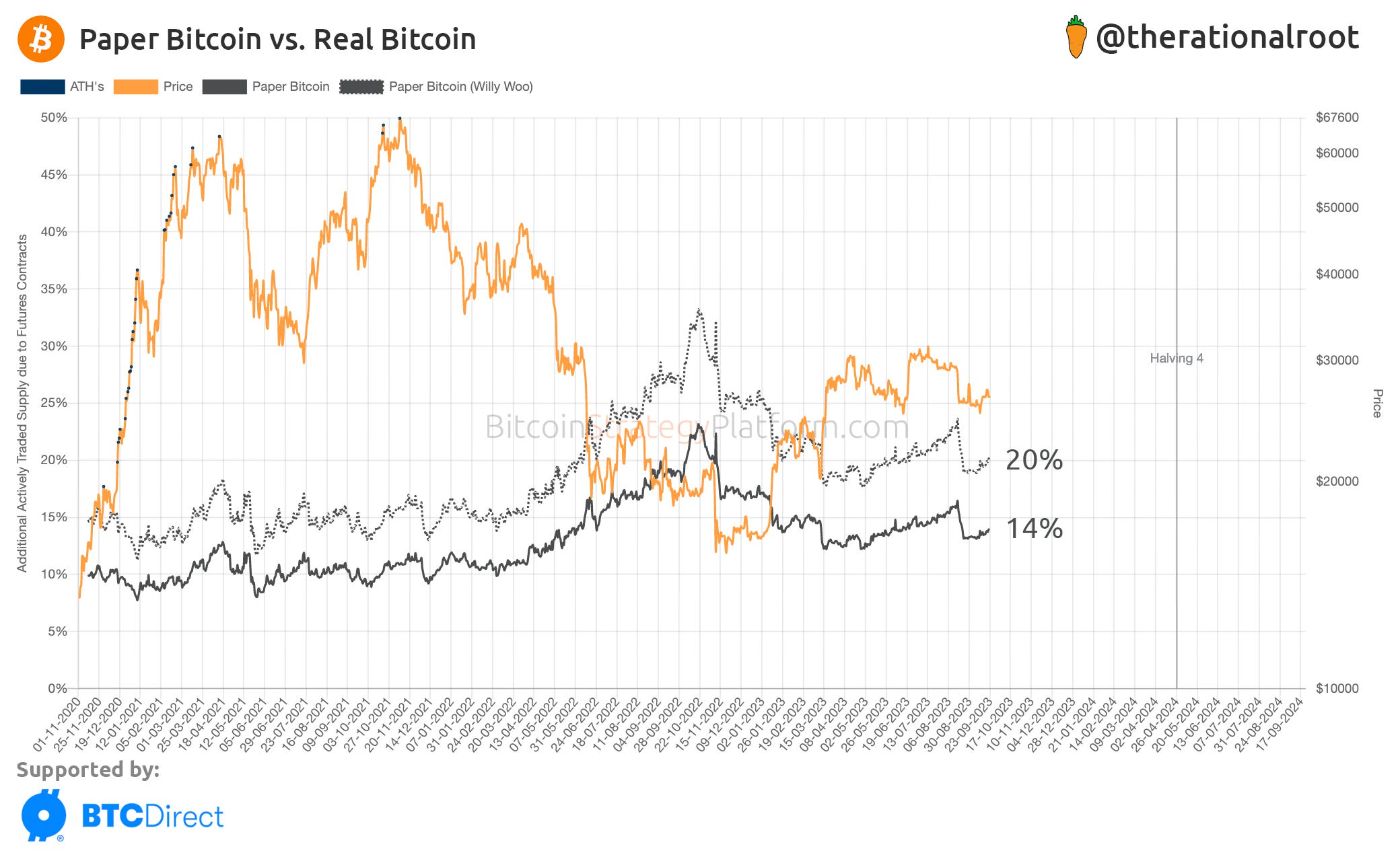

Did FTX’s paper on Bitcoin practices stifle the 2021/ 2022 bull run? We’ll probably never know. One thing’s for sure, though: There was massive Bitcoin rehypothecation at FTX. When the derivatives-focused exchange blew up, they had zero Bitcoin on their arcs and 80K BTC on their books.

Since FTX’s internal system said so, their clients - who didn’t practice self-custody - thought they held BTC in their accounts. And, why would they suspect a fine fellow like Sam Bankman-Fried?

In November 2022, FTX declared bankruptcy, and a Bitcoin Twitter personality__crunched out the numbers__ behind their paper Bitcoin policies:

“Quick math:

-330k BTC mined / year this halving era

-FTX has -$1.4B in BTC on books, meaning 80k BTC

-Assuming incurred this year, means FTX "increased" BTC supply issuance 25% this year

-Others likely did same

**

**No wonder we're under prior cycle highs.

Halving math interference.”

Not only that, FTX absorbed Bitcoin buy pressure and transformed it into sell pressure. They bought BTC for their clients and lent it without authorization to their sister company, Alameda, who sold it to buy Solana and FTT. As Croesus puts it, the company “increased" BTC supply issuance by 25%” through paper Bitcoin creation.

https://x.com/innercitypress/status/1712130156385444033?embedable=true

These are not conspiracy theories anymore. During Sam Bankman-Fried’s trial in November 2023, the CEO of Alameda Research, Caroline Ellison, told the court, “Alameda by Sept 2022 was borrowing $13 billion from FTX customers.” When AUSA asked, “If FTX customers all tried to withdraw, what would happen?” She answered, “We did not have the money.”

About Bitcoin specifically, Ellison said:

“AUSA: What are these?

Ellison: Notes from a conversation with Sam. I wrote, keep selling BTC if it's over $20K.”

And other exchanges might be doing the same thing. There will only be 21 million Bitcoin, but the system is not immune to rehypothecation. Paper Bitcoin exists.

This Is How Do The ETFs Play Into The Story

Now that we know paper Bitcoin is on the cards let’s examine the Exchange Traded Funds’ case. Whether we like it or not, Wall Street has been involved in the space since the advent of Bitcoin derivatives. However, in January, we entered a new phase. After years of waiting, the

According to Reuters:

“Standard Chartered analysts this week said the ETFs could draw $50 billion to $100 billion this year alone. Other analysts have said inflows will be closer to $55 billion over five years.

The market capitalization of bitcoin stood at more than $913 billion as of Wednesday, according to CoinGecko. As of December 2022, total net assets of U.S. ETFs stood at $6.5 trillion, according to the Investment Company Institute.”

At the time of writing, Bitcoin’s market cap is $1.3 trillion, and the estimation is that the ETFs have bought 200% of the Bitcoin mined since their launch. It’s worth noting that even though ETFs don’t grant direct ownership of BTC, the companies responsible for them should acquire the underlying Bitcoin. And, in theory, the incentives for them to behave accordingly are present.

Analyzing__BlackRock’s ETF application__, Zerohedge concluded:

“If Bitcoin's price moves higher:

- More people likely buy BlackRock’s ETF product

- Blackrock’s total AUM will be significantly higher

- Leads to increased management fees

Hypothetically, BlackRock could be pressured by the U.S. government and ignore these economic incentives. Still, this scenario is improbable, and BlackRock has no obligation or financial incentive to comply with such a request.”

That reasoning would be more compelling if Big Business and the government weren’t the same institutions with different logos, but let’s focus on the issue at hand. The fact remains: ETFs are buying Bitcoin in record numbers, and the price is flat. Is paper Bitcoin to blame?

Possible Price Suppression

Are we in the “then they fight you” stage of the Bitcoin story? Everybody can feel the rare air; something suspicious is going on. Last week, the ETFs’ inflow was $887 million and the needle… moved back? The second largest buy so far, and BTC went to $67K. Considering BTC’s the $1.3 trillion total market cap, are we overestimating the impact of the ETFs’ numbers?

https://x.com/caprioleio/status/1798983712664850804?embedable=true

Let’s be rational and explore the other side of the possible paper Bitcoin trade. First of all, the liquidity of the US Dollar hasn’t increased since Bitcoin’s ATH in March. Traditionally, that’s the main catalyst for Bitcoin rallies. According to the founder of Capriole, a Bitcoin hedge fund, other factors could be that “summer is a typical lull in the market and a risk off period for many major asset managers,” and “long-term holder selling.”

It’s true that “selling into price appreciation is typical behaviour,” and Capriole’s numbers could explain further:

“Hodler's, those that have held 2+ years, share of total supply has dropped from the 57% all time high in December 2023 to just 54% today. While -3% doesn't sound like much, that's the same as about 630K Bitcoin, or about 300% of the total amount purchased by all of the Bitcoin ETFs in the US this year.”

Also, as they adjust to the halving’s shock, miners are probably selling like there’s no tomorrow. However, this could all be true while Bitcoin price suppression is still on the table.

Maybe Coinbase and the companies behind the ETFs are not creating paper Bitcoin, but according to

Is Wall Street Using Bitcoin Derivatives To Suppress Price?

According

“Another aspect worth considering is that futures trading is a two-way street: for every short position, there's a long. The market's structure prevents unlimited short-selling to suppress Bitcoin's price, as there must be an equal number of long positions willing to take the opposite side of the trade.”

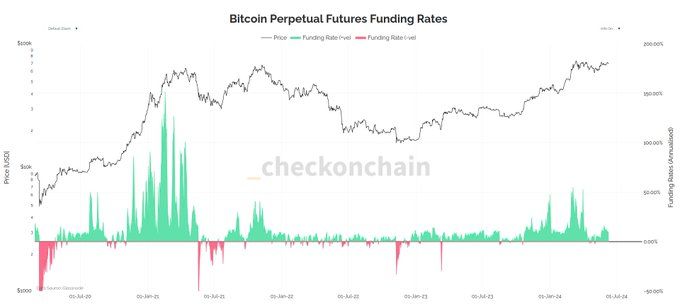

However, there’s an “arbitrage opportunity, where a trader can long spot (or ETFs), but then short the futures,” according to

“- For perpetual swaps, the yield is dynamic and volatile. For calendar futures it is fixed and expires at a certain date. Traders can then roll that onto the next contract.

- The position is neutral with respect to price risk as it is long spot, short futures. They are not going to be liquidated unless they mess up their collateral or strategy.

- Such positions add buy side to spot and ETFs, and short side to futures. Overall, this adds depth, volume and liquidity to Bitcoin markets, but is relatively neutral on market impact.”

Is that what’s happening? Are institutional investors hedging their positions and nothing else? According to _Checkmate this is positive, because “the entire reason this trade exists is because people are net bullish, long, and pushing futures prices higher.”

If that’s the situation, Bitcoin educator

“Accept that ETF demand does not contribute to bitcoin price or adoption, and expect some of that interest will be converted to genuine bitcoin buying. When we have nearly all the bitcoin in self custody, the ongoing spot demand will cause the spot price to decouple from ETF price.”

Take note: self-custoding Bitcoin is the key.

The Last Word On Paper Bitcoin

Does the explanation in the previous section mean that paper Bitcoin is not a factor? HELL NO. Centralized exchanges might be rehypothecating the funds of all their customers as you read these lines. What’s stopping them? They have zero obligation to show proof-of-reserves and, let’s face it, that Bitcoin is theirs unless their customers take it into self-custody.

Another relevant factor is that Big Business and the government are one and the same. If they have to sacrifice a few billion to create paper Bitcoin and stifle Bitcoin adoption, they can do it in a heartbeat. What’s stopping them? After all, they can print all the fiat currency they want out of thin air.

Let’s not forget Coinbase and how suspicious it is that most companies issuing the ETFs rely on them for custody. Brian Armstrong’s anti-Bitcoin stance is well documented, and their pro-compliance approach basically means they work for the government. Would Coinbase create paper Bitcoin if they were ordered to?

The more relevant question is this one: Is the US Government attacking Bitcoin by creating paper Bitcoin? As it usually happens when it comes to any government, there’s no proof of anything, and their intentions are hidden behind a thousand masks. Do they consider Bitcoin a threat? Or do they see it as the cornerstone to the real civilization we all deserve?

In any case, and this is the last word, the solution to the paper Bitcoin problem is in the Bitcoiners’ hands. The more Bitcoin into self-custody, the riskier it is for centralized exchanges and other institutions to create paper Bitcoin.

Imagine the supply shock Bitcoiners could generate.

Imagine the bank runs as everyone tries to get their Bitcoin out of the exchanges.

Imagine the paper Bitcoin problem fading into oblivion.

Self-custody your Bitcoin and sit by the river, bitcoiner. Let’s wait for the bodies of our enemies to float by.

This was a dispatch by Eduardo Prospero, Bitcoin’s ambassador to Hackernoon.

In case you missed them, these are the previous dispatches →

1 - “Why BITCOIN ONLY? - Bitcoin is NOT “Crypto” 2 - “Bitcoin Is The ONLY Digital Scarcity That Matters — Here's Why” 3.- “Bitcoin’s Weak Spot: Mining Centralization and How We're Working on It

4.- “Bringing Energy To Those Who Need It: Five Mind-Blowing Bitcoin Mining Stories” 5.- “In 2013, A Time Traveler Warned Us About Our Bitcoin Future. How Right Was He?”

Open-source images by Yegorpetrov.